Created: 20 March, Edited: 31 April

The Government of Canada has implemented new measures to help employees and business owners through the many closures and restrictions imposed.

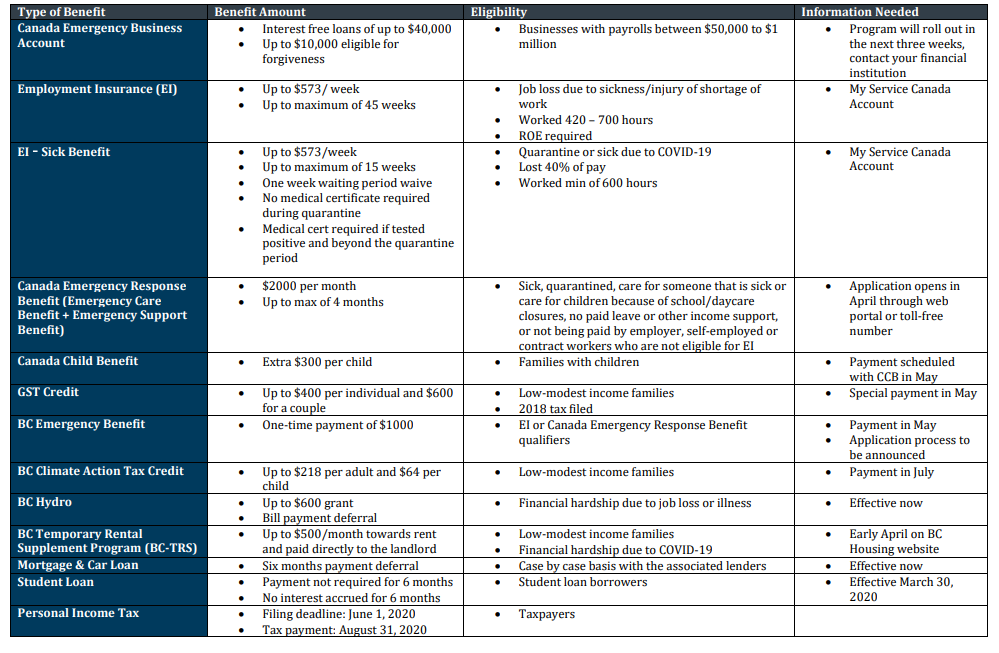

We do not have all the details on how these pieces will be delivered but here’s a summary and useful table to help you to understand how you can be supported.

Tax Filing

Instead of April 30, Canadians will have until June 1 to submit their income tax return to CRA. The Government has also extended the deadline to pay any amount owing until after August 31, 2020. This delay applies to amounts due, as well as instalments. We recommend that those who are seeing cash flow constraints file taxes as normal but defer their payment until after August 31.

Businesses will also be able to defer corporate taxes until after August 31, 2020. Again, this applies to tax balances due, as well as tax instalments; no interest or penalties will accumulate on these amounts. We recommend clients facing corporate cash flow issues to take advantage of these tax-deferrals and cancel any scheduled tax instalments up to August 31, 2020.

CRA will allow all businesses to defer, until the end of June 2020, any GST/HST payments or remittances that become owing on or after March 27, 2020, and before June 2020.

Benefits for small businesses

You can apply for a 75% wage subsidy of up to $847 per employee through the Canada Emergency Wage Subsidy. The subsidy is for up to 3 months, retroactive to March 15, 2020. On top, the Government will cover 100% of employer-paid contributions. This will help businesses to keep and return workers to the payroll. Eligibility is linked to the impact of COVID-19 on sales, the business needs to demonstrate at least 15% revenue drop in March and 30% in April and May.

There is also the 10% Temporary Wage Subsidy for Employers, a three-month measure that will allow eligible employers to reduce the amount of payroll deductions required to be remitted to the Canada Revenue Agency (CRA). This subsidy is effective immediately and provides up to $25,000 in assistance per employer, with a maximum support of $1,375 per employee. This subsidy applies to all corporations eligible for the small business deduction. Businesses can benefit from this support immediately by reducing their remittances of income tax withheld on their employees’ remuneration. Government FAQs on this wage subsidy can be found here.

The Government will fund interest-free loans of up to $40,000 with up to $10,000 eligible for forgiveness if repaid by 2022. This is for businesses with payrolls between $20,000 to $1.5million. The program, Canada Emergency Business Account, is being rolled out over the next few weeks and will be administered through financial institutions.

The Canada Emergency Commercial Rent Assistance Program is just being introduced. Loans, which could be forgivable loans, will be provided to commercial landlords to lower or forgo rent collections for small business owners from April to June. This is still being coordinated between Federal and Provincial Government so stay tuned for future updates.

Benefits for those with children

Parents will receive a $300 Canada Child Benefit top-up per child. CRA encourages individuals who expect to receive Canada Child Benefit not to delay filing their return to ensure their entitlements for the 2020-21 benefit year are determined correctly.

Benefits for those who are experiencing a loss in earnings

The Canada Emergency Response Benefit provides $2000 per month for up to 4 months for individuals and people who are self-employed, the eligibility criteria has been extended so that people who earn $1000 or less can still apply. Seasonal workers are now eligible, that includes anyone that was supposed to do seasonal work or students that had a summer job lined up.

Mortgage Deferrals

The Canada Mortgage and Housing Corporation (CMHC) and other mortgage insurers are going to offer tools to lenders that can assist homeowners who may be experiencing financial difficulty. These include deferring payments, loan re-amortization, capitalization of outstanding interest arrears and other eligible expenses, and special payment arrangements.

The Government is providing increased flexibility for homeowners to defer mortgage payments on homeowner CMHC-insured mortgage loans. Payment deferral can begin immediately.

Canada’s big six banks (RBC, TD, BMO, Scotiabank, CIBC and National Bank) have also released a joint statement that they will allow mortgage payment deferrals for up to six months; there is yet to be any clarification as to whether interest would accrue during this time. The option for deferral is set to be reviewed on a case-by-case basis and does not apply to all homeowners. They have also announced opportunities for relief on other credit products; these will also be reviewed on a case-by-case basis.

If you are concerned about loan obligations, we suggest reaching out to your financial institution to see what can be done.

Other announcements

Federal student loans will see a six-month deferral on all payments and interest from March 30

Minimum RRIF withdrawals will reduce by 25% in 2020 for retirees

Low-income Canadians will see an increased GST tax credit of $400, couples will be eligible for $600. As with recipients of CCB, we recommend those receiving GST credits to file taxes as usual.