If you’ve been following recent headlines, you’re likely aware that markets are experiencing a significant correction. Corrections happen when the market sees a decline of 10% or greater.

While there is no question that volatility can be unsettling, it is normal. To offer peace of mind, here’s some information to help answer your questions.

How often do market corrections happen?

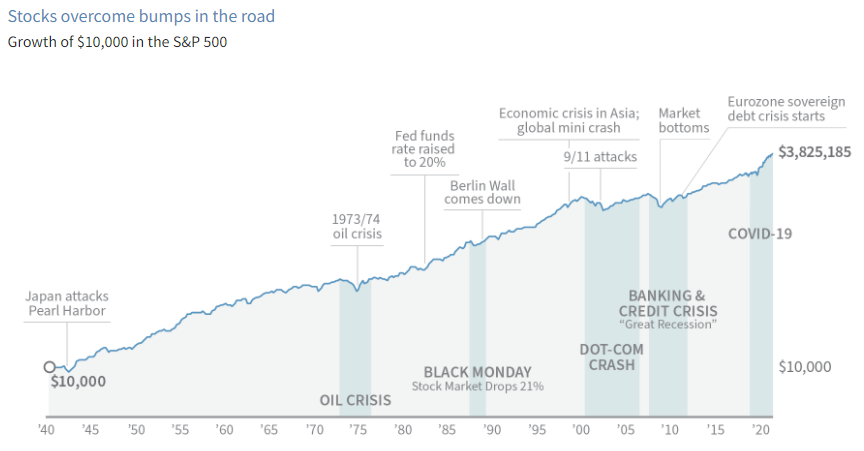

Market corrections are part of the natural cycle of the stock market. To illustrate this, the graph below shows the historical US stock market corrections. This happens every couple of years, on average. The drops often will correct and recover stock prices to their long-term trend, hence the term market correction.

(Before you make any investment decisions, be sure to ask these 4 questions.)

What is causing this correction?

The main culprit of this correction is the shockwave caused by the global governments’ response to the pandemic. To accommodate the economic effects of the restriction, the global governments pushed interest rates to near zero. All of which has led to surging inflation.

Now to constrain inflation, central banks around the world have either announced or begun raising interest rates, and with high-interest rates comes volatility.

The market turbulence is further heightened by the economic sanctions against Russia as the geopolitical tension between Russia and Ukraine continues.

What should you do in a market correction?

Staying the course is critical in times of volatility.

Historically speaking, there are more positive years than negative, and markets have always recovered and posted gains again. It is important to avoid any emotional reactions.

Being patient; staying invested for the long term is likely to be rewarded.

Aside from staying the course, here are some next steps investors can take action on:

- Reevaluate your risk tolerance using our Investor Risk Profile Questionnaire. Market declines can serve as a reminder to reassess how much loss you can cope with financially and emotionally. Reach out to your financial advisor to discuss your risk profile.

- Review your financial goals. If there are changes, it’s important to see if your portfolio still aligns with your long-term financial goals.

- Visit your investment portfolio and see if it reflects your time horizon. Make sure you are aware of when you need the money and whether the risk of the investments matches your time horizon.

(Here are 12 investment planning FAQs every business owner needs to read.)

The Ocean 6 team is closely monitoring the situation. A depressed market can offer buying opportunities, and as the situation evolves, we’ll be working with our clients to make the most of them.

Having a portfolio built around your goals and risk tolerance will help you remain composed in times of volatility. If this is not yet part of your financial plan, book a call today.