Often clients approach us wanting to leverage – a process that involves borrowing funds to invest in the market.

When stock prices and valuations are high, as they have been in recent years, we are cautious about recommending leverage as a financial strategy.

The reality is now significantly different.

The market is currently in decline, TSX and S&P stock markets have both plummeted over 30% from their 2020 high and assets are on sale. We cannot be sure we are at the bottom, but we do know that there is a significant opportunity.

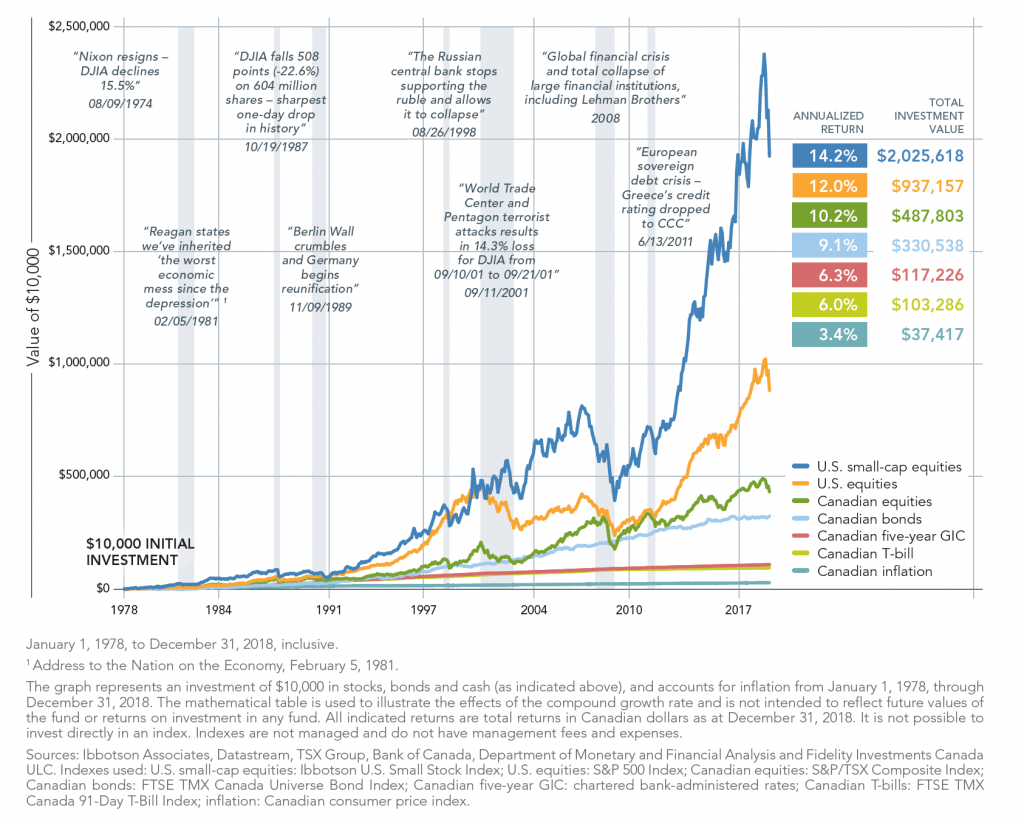

Major global events have caused declines in the past, but as the graph shows, the market will recover.

What to think about when leveraging

Plan for an extended period to ensure you make money: We recommend about seven years. You don’t have to stay invested for all this time, just plan long-term as the current volatility may continue.

You must be comfortable paying interest out of your cash flow: You don’t want to be in a situation where you have to sell investment assets to pay the interest.

Remove the emotion: This is a long-term strategy, and you are entering at 2016 stock prices. If we are not at the bottom and we see another 10-20% decrease, then you need to stay invested.

If you want to learn how to effectively structure your investment portfolio, book a call, we’d be love to run you through our full financial planning process.